D.H.O. Travel & Tax Service

Our agents have cruised and traveled extensively throughout Europe, the Caribbean, Mexico, Costa Rica, South America & the US. We have the first hand knowledge and expertise that you can only get by being there. If you need help planning your Bachelor/Bachelorette party's, Honeymoon, or family vacations give us a call or drop an email. We will be more than happy to assist you along the way.

Notary Services

Notary services are now available. Please ensure you have government issued ID (drivers licenses, non driver ID or passport). Please wait to sign the document in my presence only.

Fabulous

Curacao

December 2022

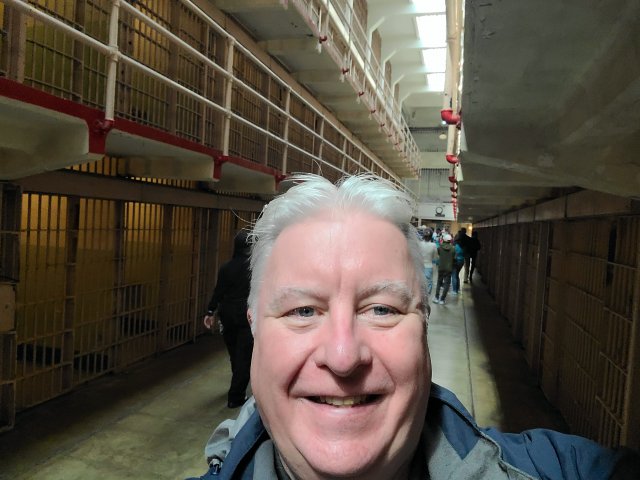

San Francisco April 2022

Secrets Akumal Dec 2019

Secrets Akumal Dec 2019

Secrets Akumal Dec 2019

Secrets Akumal Dec 2019

Kentucky Derby 2019

The Boys Kentucky Derby 2019

Mint Juleps at the Kentucky Derby

The Girls Kentucky Derby 2019

Kentucky Derby 2019

Secrets Maroma Beach Dec 2018

Secrets Maroma Beach Dec 2018

Secrets Maroma Beach Dec 2018

Diamond Head Honolulu, Oahu Jan 1 2018

Halekala Crater Maui Jan 10 2018

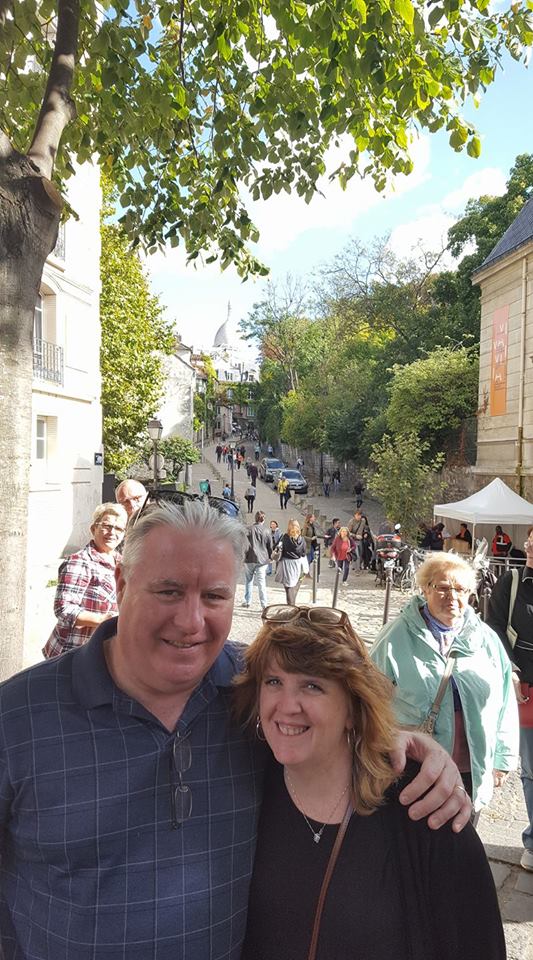

Montmartre Paris Sept 2017

Pisa 2017

Como - August 2017

Bellagio - Lake Como - August 2017

St Marks Square - Venice - August 2017

St Marks Square - Venice - August 2017

Atop Torc Mountain - Killarney July 2016

Perfect Pint

Friends...

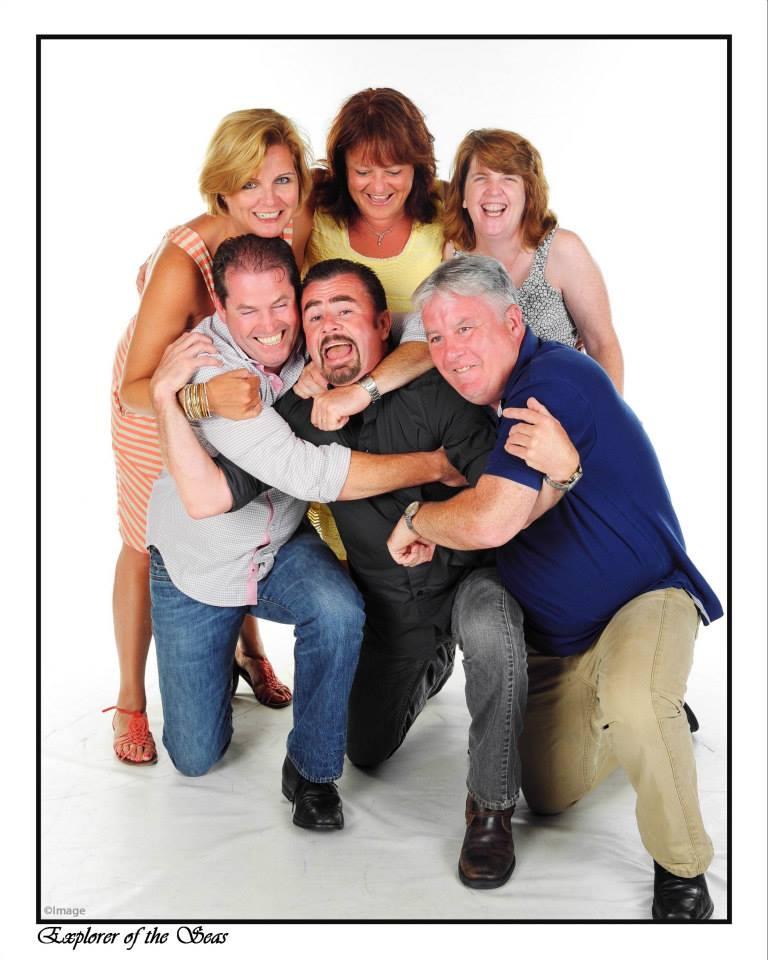

Explorer of the Sea's 2013

Horseback Riding - Arenal, Costa Rica. 2012.

Haleakala Crater - Maui, HI

Sunset - Kaanapali, Maui, HI

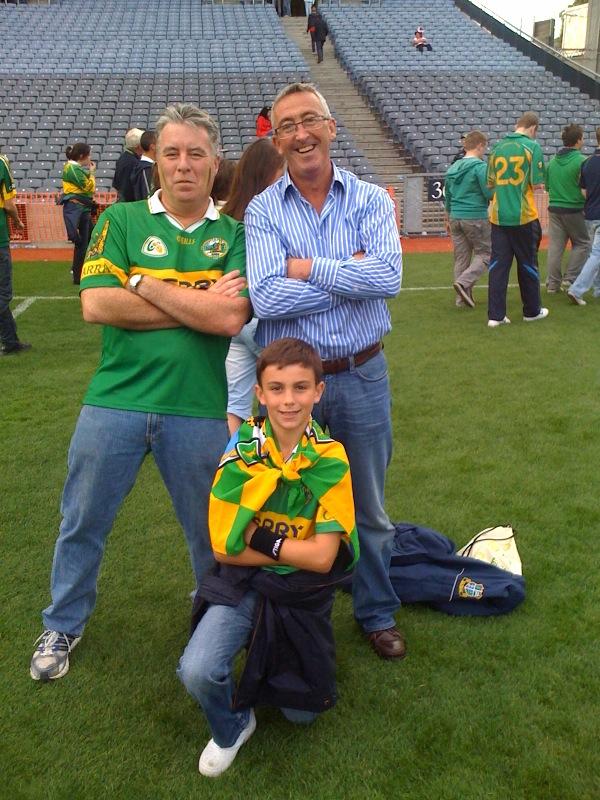

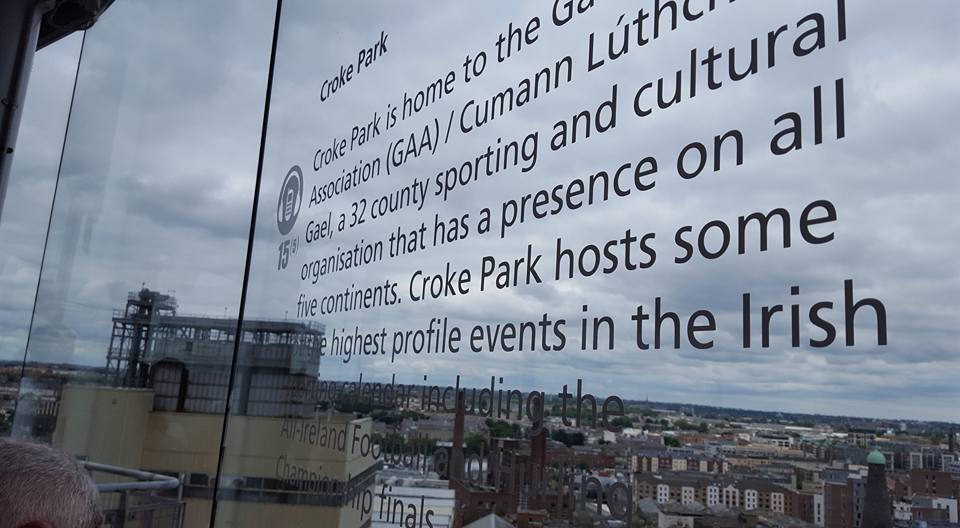

Croke Park - All Ireland Football Final - Dublin, Ireland

Maui Brewing Company Jan 2018

Musee D'Orsay Paris Sept 2017

Sorrento

St Peters Rome - August 2017

St Marks Square - Venice - August 2017

Burano - Venice - August 2017

Great Company in Maynooth, Ireland 2013.

Mythbuster's - San Francisco

Mountain Paradise Hotel - Arenal Costa Rica 2012

Sunrise at Haleakala Crater, Maui, HI

La Buena Vida, Akumal, Mexico

Golden Gate, San Francisco, CA

The Croker, Plan B. Dublin, Ireland.

Plan "B"... Croke Park, Dublin

Maui Sunset Jan 2018

The Mill Restaurant - Maui Jan 2018

Eifel Tower Sept 2017

Rome August 2017

Florence River Arno

Florence 2017

Torc Mountain Killarney July 2016

Gravity Bar Dublin July 2016

Hard Rock Riviera Maya 2014

Hard Rock Rivera Maya 2014

The Group on the Beach - Hard Rock Riviera Maya 2014

St Martin - July 2014

St Martin July 2014

Orient Beach St Martin July 2014

Oasis of the Seas July 2014

Oasis of the Seas July 2014

Atlantis - Paradise Island July 2014

We’ve been everywhere. If you’d like to join us as we travel to our next destination, we’d like to hear about your plans.